Market Update - May 29th, 2023

Please Tell Me WHY Rates Continue To Increase!

Contrary to popular belief, the recent rise in interest rates has more to do with economic data than the recent battle with the debt ceiling. I bet you could all guess the main economic driving force. That’s right – inflation.

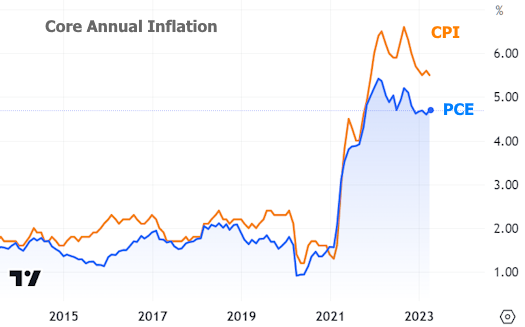

Inflation remains stubbornly high and has been unwilling to decline in any meaningful way. We know at some point the recent rate hikes will begin to have an impact and inflation will decline. But how long will this take? As you can see from the chart below, the two main inflation reports that the Fed tracks clearly indicate that inflation has leveled off. These results were exacerbated with the higher-than-expected PCE inflation report that was released on Friday. The report on Friday was the worst inflation data we have seen all year. It showed that inflation increased for the first time since October 2022 and previous data was revised higher as well. This is worrisome as the Fed has continuously stated that their primary target range for inflation is at or below 2%. Clearly from the recent inflation data, we can expect the Fed to hold rates higher for longer until we start to see a meaningful decline ☹

Debt Crisis Averted! Any Immediate Impact on Borrower’s?!

As we have all heard by now, it seems that both sides of the aisle have reached a tentative agreement to raise the US debt ceiling. This is good news for the American people as it prevents what could have been a catastrophic default, which undoubtedly would have led to a deep recession.

Now that the main crisis has been averted, our immediate attention has shifted to what details of the bill could affect us in the Real Estate market. The main subject that stood out to Nick and I was Student Loans.

If the debt ceiling agreement were to pass on Wednesday, student loan payments could resume as early as August 1st. This is one month sooner than the previously announced date of September 1st.

Currently, there are $1.6 trillion in student loans with payments that have been suspended since early 2020. We have gone 3+ years without having to make one single payment on a student loan.

We pull 100+ credit reports monthly. We see firsthand the type of strangle hold student loan debt has on the everyday hardworking American. The resuming of student loan payments could not come at a worse time. Those who owe student loans will resume payments in a high interest environment, with increasing consumer debt, and dwindling savings. Restarting student loans might just be the straw that breaks the camel's economic back.

Could a Recession Bring You More Business?

Clearly you can see from the chart above that the everyday consumer is getting squeezed, fast. At some point, the debt crisis will worsen and the people that are homeowners will seek reliable sources of knowledge to help them navigate the market. We have already seen it firsthand with past clients inquiring about cash-out refinancing to pay off debt or others seeking advice on selling as they know the market is still extremely hot. You never know who might be struggling and a simple call from you regarding the value of their home could be spark they needed to realize the equity goldmine that they might be sitting on. It’s the time of uncertainty and unpredictability that our past and present clients need us the most. Make sure you are that trusted source of information 😊

Instagram Posts from Last Week