Market Update - June 26th, 2023

Expect Rates Higher For Longer

We’ve said it in the past and we will say it again: It’s time to adjust our belief that rates will decrease within the next 6-12 months. The truth of the matter is that rates in the 6% range might be our new norm, and surprisingly, we are ok with this reality! Even though interest rates have remained high, the volatility of rates has died down. This has brought a sense of stability to the market. When rates were adjusting in 2022, we observed buyers experiencing the highest level of frustration when interest rates surged while they were actively searching for a home. Many surrendered and gave up their search as affordability continued to dwindle with the ever-increasing rise in rates.

Key Takeaway: This past month we have noticed a shift in buyer sentiment with rates remaining in the mid to high 6% range. With rates remaining consistent throughout their search, buyers are choosing to persist with their pursuit of finding a home without the fear of sudden rate increases. Their perception of affordability has remained unchanged, allowing them to proceed with their home search confidently. Even if rates remain at these elevated levels, we will take stability over volatility all day and night 😊

New Construction is Booming!

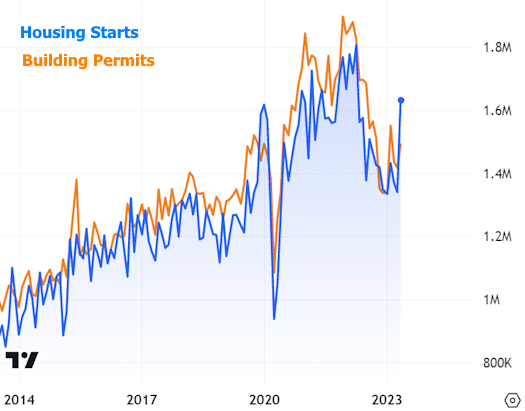

We can all agree that the main issue with the housing market right now is the lack of inventory. Builders are doing their very best to keep up with demand. Housing starts grew by a whopping 21% from April to May, according to the U.S. Census Bureau, which is incredible! Considering the scarcity of existing homes for sale in this current market, this spike in new construction comes as no surprise to us. Builders continue to offer phenomenal incentives with their deep pockets to move inventory, such as reduced interest rates, free options, seller contributions, etc.

Key Takeaway: If you have a client that has been struggling to find a home in the $400k+ price range on the existing market, you are doing them an injustice if you don’t mention the idea of building. If we could only get the builders to build homes under $350k again, THAT would be truly amazing 😊

Two More Rate Hikes This Year

Federal Reserve Chair Jerome Powell provided his regular update to Congress this past week and shed light on the Fed’s outlook for the future. Assuming the economy continues to progress as predicted, the Fed anticipates two more interest rate hikes this year before reaching their target level. These expectations are based on a cooling labor market, modest economic growth, and a decrease in inflation.

Key Takeaway: In simpler terms, the bar for justifying additional rate hikes is set quite low. Only if the economy deteriorates significantly would the Fed consider refraining from raising interest rates. On the other hand, if the markets continue to improve beyond expectations, we might see more than two additional rate hikes.

Instagram Posts from Last Week