Mortgage Update - April 29th, 2024

Inflation Continues in Wrong Direction🔺

We've said it time and time again, interest rates tend to move the most when it comes to inflation data and Fed policy. This past week was no different as we saw mortgage rates swing to near 2024 highs due to the quarterly PCE Inflation report that was released on Thursday. The quarterly data showed a big surge in inflation, which immediately pushed rates to the 7.50% range.

It is evident the financial markets are quickly losing confidence in the Federal Reserve's ability to bring inflation down to their target level of 2%. It is safe to assume that the Fed has no choice but to keep rates higher for longer.

Key Takeaway: The higher-than-expected inflation numbers continue to push the Fed rate cuts further into the future. We will need to see a drop in inflation and a weaker economy before the Fed begins to pivot. Interest rates in the 7's are starting to be the new norm.

Investors Taking Bite Out of American Dream 😩

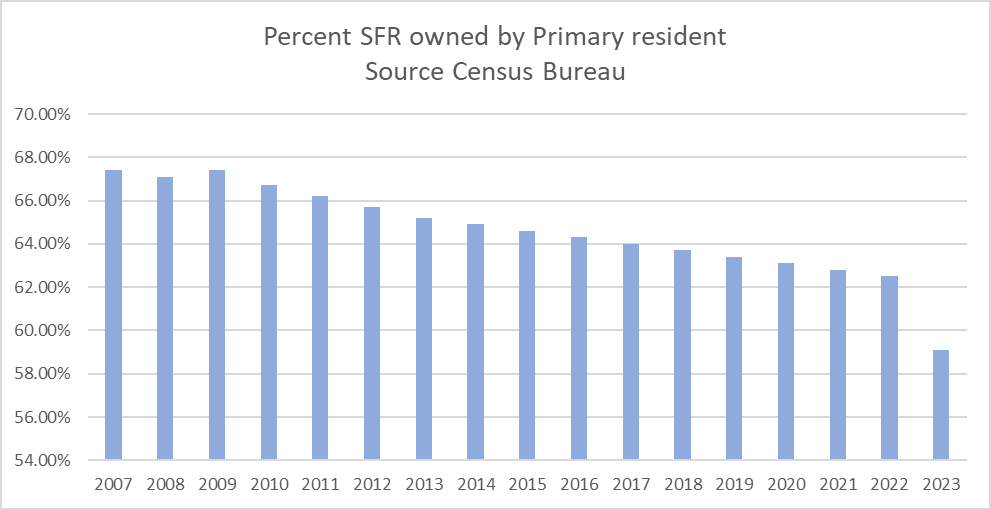

In a surprising development, the percentage of homes owned by primary residents has dropped below 60%. The increasing influx of investors into residential real estate is becoming a very concerning trend.

Companies such as Blackrock, American Homes 4 Rent and Vanguard are robbing Americans of the ability to own homes. These mega corporations are monetizing housing and gobbling up single family homes at a rapid pace. They are investing to dominate the market, essentially establishing a monopoly in the real estate world.

The problem worsens as the average American faces rising costs. Increased interest rates, property taxes, and homeowner's insurance premiums are making it extremely difficult for the everyday citizen to compete with hedge funds. A mortgage rate of 7.50% has nearly no impact on mega corporations, as they use cash to outmatch their competitors.

This is a disturbing trend that demands our attention. Consider carefully before advising your seller to accept a slightly higher offer from a major corporation. Once a home is sold to a mega corporation, it may never reappear on the market again 🙁

It’s Fed Week 👀

Remember in the beginning of the year, we were all talking about 6 to 7 potential rate cuts in 2024?! This week's Fed meeting was supposed to be the first meeting in which we expected the Fed to cut rates. How quickly things can change in a matter of a couple months.

We expect fireworks from this week's meeting, as they respond for the first time to the uptick in PCE, PPI, and CPI Inflation data. We anticipate Jerome Powell to face tough questions about his next course of action, given we've just experienced the first two-month increase in inflation since September 2023.

While we would love a hear a clear strategy from Powell regarding the timing and method of future rate cuts, we expect him to offer more of the same. Don't be shocked to hear the familiar rhetoric; he'll likely reiterate the need to see inflation trending towards 2% before it would be appropriate to lower rates.

Key Takeaway: Expect the same dog and pony show from Powell. He'll express the need to bring inflation down to the target of 2% without offering concrete guidance on his approach to achieving this goal.