Mortgage Update - January 27th, 2025

The US installed a new president last week and the executive orders were flying within hours of inauguration. Kreg and I fully expected some major volatility, but shockingly it was a quiet week with some of the lowest volatility in years.

I think that all changes this week. We are already seeing futures markets bleed on the news of DeepSeek, from China, potentially upending the US tech sector and there appears to be a de-risking ahead of Jerome Powell’s meeting on Wednesday. On a positive note, volatility and uncertainty tend to lead to mortgage rate improvements 😅

We are posting regular content to Instagram (Nick | Kreg) and Facebook (Nick | Kreg) to help you and your buyers stay informed. Be sure to follow us!

Read time: ~4 minutes

Worst Housing Market Since 1995 🏠📉

First of all, don’t panic 😱

I remember going to a live demo of Windows 95 with my mom back in the mid-90s. She would occasionally take me to the local university to play around with this new thing called “the Internet”. Amazon, at that time, only sold books and Toy Story just hit the theaters.

That year, there were only 3.85 million existing homes sold.

Fast forward to 2024, where NAR states existing home sales hit just 4.06 million. That’s the lowest number since 1995.

The US has almost 75 million MORE people in 2024 vs. 1995. Available existing home inventory is DOWN over 500,000 units in 2024 vs. 1995. Mortgage rates are actually DOWN in 2024 at 6.72% vs. 7.93% in 1995 (BUT I’d much rather have 7.93% on a median sale price of $114,600 in 1995 vs. 6.72% on $407,500 in 2024).

In 1995, 42% of homebuyers were first-timers. Compare that to 2024, when first-timers only make up 24% of buyers, a historic low. The average age of a first time buyer in 1995 was 31 vs. 38 in 2024.

Most would look at these stats and puke. Kreg and I look at these as opportunities…pent-up demand is building. The question is will you be prepared when they flood back into the market?

Anecdotally, the first month of the year has some steam behind. Applications are on the rise and people are stepping back into the market who may have moved to the sidelines in 2024. Consumers are getting used to these higher rates and life is still happening. Families are growing and need more space, folks are yearning to move out to more rural parts, the older generation are down-sizing.

Are you preparing?

Key Takeaway: 2024 is way different than 1995 in a lot of ways. The population is much larger, existing home inventory is way down, prices are much higher (basics of supply and demand) and the buyer demographics a skewing much older. We will see a reversion to the mean at some point and those that are sowing seeds now will reap an insane harvest.

Can Trump Lower Interest Rates? Here’s the Reality

On Thursday, while speaking to a group of global leaders at the World Economic Forum in Davos, Switzerland, President Trump let the Powell and the Fed know he wants rates lower.

“I’ll demand that interest rates drop immediately.”

President Trump wants the Fed to slash rates immediately, claiming it’s vital for economic growth. But here’s the kicker: the Federal Reserve is independent, and it doesn’t take orders from the president. While Trump can appoint board members, the Fed’s decisions are driven by economic data, not political pressure.

With inflation easing and markets pricing in future rate cuts, the Fed’s focus remains on long-term stability—not reacting to political demands.

For now, rate reductions in the later half of 2025 are more likely tied to cooling inflation trends than presidential influence. 🏦✨

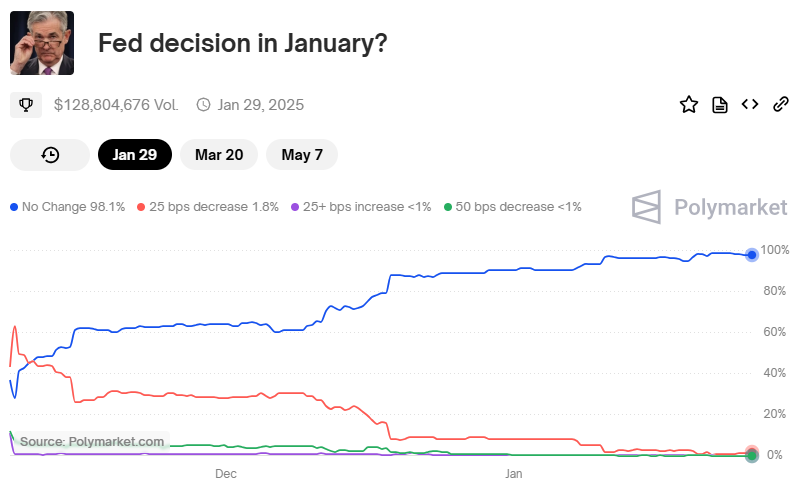

The next meeting of the Federal Reserve Board is this Tuesday/Wednesday. At this time, markets are expecting a rate PAUSE Wednesday afternoon. Kreg and I will be listening to the press conference following the announcement to see how Powell reacts to questions regarding Trump’s comments.

Key Takeaway: Trump wants to use a bazooka to pull rates back, but unfortunately that’s not how the Federal Reserve operates. We are expecting a pause in rate cuts this week, which is likely for the best as the US labor market has stayed ferociously strong and inflation is starting to tick back up.

Ohio is Still Affordable…Relatively Speaking

Affordability is top of mind these days, and the Buckeye State is holding its ground!

A recent report by doxoINSIGHTS ranks 4 Ohio cities among the top in AVERAGE HOUSEHOLD SPENDING for typical services like housing, insurance, and utilities:

The firm analyzed spending across typical products and services including alarm & security, auto insurance, auto loan, cable & internet, health insurance, life insurance, mobile phone, mortgage, rent and utilities.

Cleveland (#2)

Dayton (#3)

Cincinnati (#15)

Columbus (#18)

What’s not on the chart is % OF HOUSEHOLD INCOME needed to cover the average spend. In Detroit, for example, it takes 53% of the household income to cover the spend, suggesting Detroit’s incomes are low relative to other states. In Columbus, for example, it only takes 39% of the household income to cover the spend.

Living in Ohio means more room to save for future goals. Affordable living FTW! 🙌✨

Keynote Speaker Announcement Wednesday 👀👀

Let this be your warning y’all! 😂

THIS WEDNESDAY is the big reveal! Find out first who the keynote speaker will be at this year’s Rebel event. You won’t want to miss this!

I don’t want to hear “How did I miss this?” or “you never told me”.

Psst, we have 400 people already signed up and we don’t have 400 seats available.

Mark your calendars for February 13th 10AM to 2PM. Zoom announcement event is on January 29th at 11AM 💪💪