Mortgage Update - July 8th, 2024

Hello everyone! I hope you had a wonderful and relaxing July 4th weekend! We’ve got a big week ahead in the mortgage world, and we’re here to break it all down for you!

We are posting regular content to Instagram (Nick | Kreg) and Facebook (Nick | Kreg) to help you and your buyers stay informed. Be sure to follow us!

Read time: ~4 minutes

Rates Dip as Cracks Begin to Show ⬇️

Nick and I are the first to admit that the first half of this year has left us puzzled. Sky-high interest rates and inflation have been tough on everyday consumers, yet the stock market has continued to soar to all-time highs, and unemployment remains low.

In a "normal" market, these signs would be celebrated as indicators of a strong, resilient economy. However, this time is different. The Fed began raising rates in March 2022 to cool the economy and bring inflation back to its target range of 2%. Despite these actions, the economy has given the proverbial middle finger to the Fed rate hikes as the economy has remained red hot. However, we are starting to see some cracks...

On Friday, we had the BLS jobs data released for the month of June, showing another higher-than-expected job count. The economy added 206k jobs, compared to the expected 190k. Typically, blowing away job expectations would lead to a spike in interest rates as it indicates a strong job market. However, the opposite happened due to significant downward revisions for the previous months.

May jobs were revised lower from 272k to 218k

April jobs were revised lower from 165k to 108k

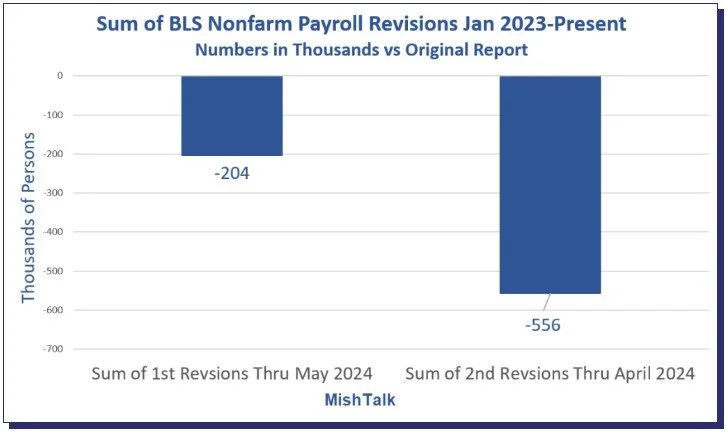

As you can see, these revisions subtracted 111k jobs from the previous totals! It's almost comical how often the initial numbers beat expectations only to be revised lower the following month. Since January 2023, the non-farm payroll revisions have wiped out 204,000 jobs in the 1st revision and eventually 556,000 by the 2nd!

It seems the market is catching on to this trend, as the interest rate market responded more to the downward revisions, causing rates to drop 🙂

Key Takeaway: Rates moved lower to end the week due to downward revisions in previous job reports. Unemployment also increased slightly from 4.0% to 4.1%. This rise in unemployment is positive news for mortgage rates. If unemployment continues to climb, we can expect mortgage rates to trend downward. While the average top-tier 30-year fixed rate isn't back under 7% yet, as of Friday, it’s getting close.

Will This Week’s Inflation Data Signal Rate Cut ✂️

A huge week ahead for us in the mortgage world as all eyes will be on the the CPI inflation report on Thursday and the PPI inflation report on Friday. We'll be on edge as this inflation data could influence the Fed's next move.

Powell has repeatedly emphasized that the Fed needs more positive data to gain confidence in the easing of inflation.

If the inflation data continues to trend down towards the 2% target level, the Fed might signal a rate cut as early as their September meeting. However, if inflation remains stagnant or increases, expect mortgage rates to rise.

Key Takeaway: This week's inflation report could be the most crucial of the year. The markets are eagerly hoping for the Fed to cut rates soon. A low inflation reading would give the Fed the confidence to lower rates as early as September. However, a high inflation report would make it very difficult for the Fed to justify cutting rates anytime soon.

Brandi Snowden/Dr. Yun Masterclass Recap

A few weeks ago, we shared a link to a masterclass hosted by Tommy Choi, a Chicago area top agent. He interviewed Brandi Snowden (Director of Member Research at NAR) and Dr. Lawrence Yun (Chief Economist of NAR) on the future of real estate.

In their conversation, Brandi noted 32% of home purchases are by first-time buyers. Additionally, 59% of buyers were married couples, 19% single females, 10% single males and 9% were unmarried couples. It’s awesome to see single females bettering their financial future and jumping into homeownership in a meaningful way!

Another interesting takeaway was that 14% of homebuyers purchased a multi-generational home, whether that’s to take care of aging parents or for cost savings.

Dr. Yun had some optimistic points:

The “golden handcuffs” of homeowner’s reluctant to sell due to low mortgage rates could come off as major life events force a move

Price reductions are occurring often due to initial overpricing rather than market shifts

I encourage you to check out the recording. It can help with targeting a specific clientele or build out your knowledge base to be a stronger, more well-rounded agent.