Mortgage Update - July 7th, 2025

Can you believe we’re already halfway through 2025? Q2 is in the books, July is here, and summer’s in full swing!

But don’t expect any slow, sleepy “dog days” in this economy—things are legit getting crazier by the week! Buckle up, because we’ve got another wild (and holiday-shortened) week to break down. Let’s get it!!

We are posting regular content to Instagram (Nick | Kreg) and Facebook (Nick | Kreg) to help you and your buyers stay informed. Be sure to follow us!

Read time: ~4 minutes

"Big Beautiful Bill" Passes - How It Affects 🫵

Love it or hate it, the "Big Beautiful Bill Act" was officially signed into law on July 4th.

So now that it’s done, what does it actually mean for us in the real estate world? Let’s break down what matters most to us in the industry:

🏡 Mortgage Interest Deduction Survives (Again): For the last 16 years of being in the business, it feels like the Mortgage Interest Deduction has always been “on the verge” of getting cut. Not this time! You can still deduct mortgage interest on loans up to $750,000. This continues to be a powerful tax perk and a helpful selling point for homeownership.

💸 Bigger Tax Break for Property and State Taxes: The bill raises the cap on how much you can deduct for state and local taxes (like property and income taxes) from $10,000 to $40,000—as long as your household earns under $500,000 a year. This cap will go up a little each year through 2029. This won’t move the needle much here in Ohio, but it’s huge news for clients in high-tax states like New York, New Jersey, and California. It makes high-end homeownership more affordable in those markets—and could drive more demand.

🏗️ 100% Bonus Depreciation Is Back: Starting in 2025, investors and developers can write off 100% of the cost of certain real estate improvements—like renovations or upgrades to commercial and industrial buildings—in the same year they buy and start using the property. Normally, you'd have to spread that tax deduction out over many years.

👩💼 Bigger, and Permanent Tax Break for Real Estate Pros: The popular Qualified Business Income (QBI) deduction is now permanent and goes up from 20% to 23% starting in 2026. This applies to small business owners, independent contractors, real estate agents, and investors—so yeah, that’s most of us. It can reduce your effective federal tax rate to under 29%, meaning more money in your pocket!

🔁 1031 Exchanges? Still Intact: Yes, Section 1031 Like-Kind Exchanges are still alive and well. That means your investor clients can keep deferring taxes when they swap one property for another—an essential tool for building long-term wealth through real estate.

Key Takeaway: The "Big Beautiful Bill" delivers major wins for the real estate industry—keeping the mortgage interest deduction, supercharging tax write-offs for investors, and locking in a bigger, permanent tax deductions. Whether you're an agent, investor, or developer, this bill puts more money in your pocket.

Say Adios to a July Rate Cut👋

Nick and I have been saying it for a while—and now the data backs it up: a July rate cut isn’t happening.

Trump’s throwing jabs at “Too Late Powell” for keeping rates elevated, while Bill Pulte (U.S. Director of Federal Housing) is calling for a full-blown investigation into Powell for “political bias” and wants him gone.

The Fed is supposed to be neutral… but let’s be honest—inflation was higher and unemployment was the same last September, and we still got a surprise 0.50% cut right before the election. Not the best look for Powell as that doesn’t exactly scream non-partisan.

But politics aside, let’s look at what actually matters: the numbers.

📊 Should the Fed Be Cutting Right Now?

Short answer: Absolutely not.

Rate cuts usually come when the job market shows signs of weakness. But the June Jobs Report landed last Thursday, and it was solid:

147,000 jobs added (only 110,000 expected)

Unemployment dropped to 4.1% (lowest since Feb)

Forecasts had it going up to 4.3%

These numbers were strong—really strong. And they gave Powell all the ammunition he needed to say, “Nope, we’re not touching rates right now.”

None. Zero. Zilch. Period.

Markets reacted fast after the hot Jobs Report:

Stocks surged

The 10-year yield spiked

And yes… mortgage rates ticked higher 😭

With the next Fed meeting on July 30, the odds of a rate cut are sitting at just 4.7%. Translation: not happening.

Trump and Pulte might be losing their ever-loving minds right now, but the bottom line is this: The Fed isn’t cutting rates anytime soon. And the market knows it.

Key Takeaway: The noise is loud, but the data's louder. With a strong June jobs report and unemployment dropping, the chances of a July rate cut are basically dead. Markets have already adjusted, and mortgage rates are trending up as a result. Expect rates to remain higher for longer.

OHFA Slashes Rates — and It’s a Game Changer 🚨

I know some of you are tuning in from outside Ohio—so you can either skip this part… or double down and start marketing the hell out of these new rates to your Ohio clients! Trust me, they’re that good!

Nick took this video of me on my way to the office to tell all my agents about the new OHFA rates:

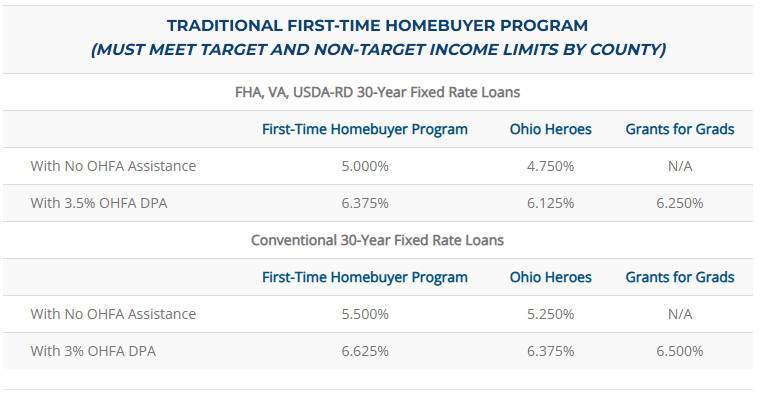

On Tuesday, July 1st, in a surprise move, the Ohio Housing Finance Agency (OHFA) dropped rates big time:

5.00% on FHA loans

5.50% on Conventional (unassisted) loans

For teachers, nurses, firefighters, police, and veterans:

4.75% on FHA & VA loans

5.25% on Conventional loans

One client in particular had her eye on a $500,000 home but was on the fence due to the payment at the current market rate of 6.75%. We reran the numbers at the new 5.25% rate:

✅ Monthly payment dropped by $386

✅ Total interest saved over the life of the loan: $138,808

✅ She placed an offer within 24 hours and is now under contract

If this doesn’t show how powerful interest rates are, I don’t know what does. The low 5’s are clearly the sweet spot that unlocks real buyer demand—and OHFA just lit the match.

We’re already seeing more activity, more urgency, and more buyers ready to move.

And we are so here for it!

Key Takeaway: OHFA just dropped rates into the low 5’s, and it’s already igniting serious buyer activity. For eligible Ohio buyers, this means lower monthly payments, huge interest savings, and a real reason to act now. And you don't necessarily have to be a first-time homebuyer! If you’re not marketing this, you’re missing the moment.