Market Update - December 18th, 2023

Hello all! Exciting weekend in the state of Ohio! Columbus Crew, Cincinnati Bengals, and Cleveland Browns all got the W! Hope you all had a winning weekend in the Real Estate world as well. We are back with the latest and greatest mortgage news.

We are posting regular content to Instagram (Nick | Kreg) and Facebook (Nick | Kreg) to help you and your buyers. Be sure to follow us!

Read time: ~4 minutes

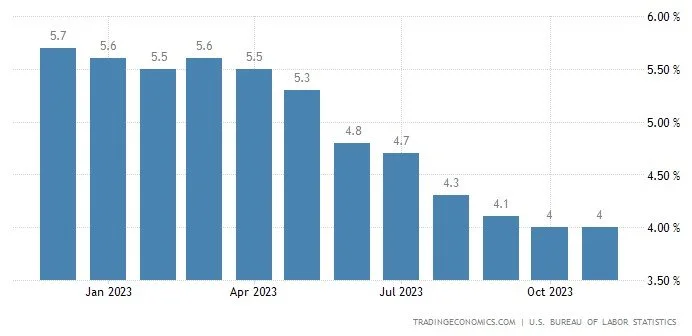

Inflation Continues to Decrease in November 📉

On Tuesday, November’s CPI (inflation) data was released. Headline inflation dropped from 3.2% to 3.1%. Core inflation (minus food and energy) remained unchanged at 4.0%.

The Fed is targeting a 2.0% core inflation rate, so we’re currently 2x where we want to be.

The market expected both headline and core to hit 3.1% and 4.0% respectively so markets didn’t move in a meaningful way after the announcement.

Chart 1 : Annual Core Inflation Rate Over Time

Inflation continues to feel very “sticky”, in our opinion. It’s not dropping fast enough to the Fed’s target. If you look at the month by month core inflation chart below, you’ll see over the summer core inflation was very low but over the last 4 months, its averaged around +0.278.

Chart 2 : Month Over Month Core Inflation

To calculate the annual core CPI, you add the monthly values together (chart 2 data points from December 2022 to November 2023 sum to the 4.0%). The only way to bring the annual core CPI down from 4.0% is to replace the December 2022 through May 2023 data points (green box) with much lower numbers. If we assume the 4 month average of 0.278 continues for the next 6 months, annual core CPI will only fall to 3.18%, which is still significantly higher than the Fed’s target of 2%.

Key Takeaway : Overall, the November CPI hit market expectations but paints a picture that inflation is still very “sticky”. We need to start seeing some significant decreases in the monthly CPI metric, well below the current 4 month average of 0.278%, to feel good about the Fed actually cutting rates in 2024. With the 2.0% target far from reach, the market needs to be cautious in anticipating major rate cuts in 2024.

Fed Chair Delivers Early Christmas Gift 🎄

On Wednesday we had the last major market-moving event of 2023. At the Federal Reserve December meeting, the committee decided to hold the Fed Funds Rate but also signaled an expectation of 3 interest rate cuts in 2024. Furthermore, during the Federal Reserve’s press conference, Jerome Powell had a very dovish tone which caught investors off guard. Markets rejoiced. Interest rates, for example, dropped to 6.82%, the lowest since May of 2023.

Many expected Jerome Powell to be the proverbial “wet blanket” and temper expectations, warning investors that he wouldn’t be afraid to hike rates if inflation stuck around. But he didn’t.

Look at how the Fed has changed it’s tune since November 1st:

November 1 : Getting inflation to 2% “has a long way to go”

November 21 : “No indication of rate cuts at last meeting”

December 1 : Talks about rate cuts are “premature”

December 1 : “We are prepared to tighten policy further” if needed

December 13 : Rates have peaked, 3 rate cuts coming in 2024

What changed?

On Friday, New York Fed President John Williams was on CNBC and said “we aren’t really talking about rate cuts right now”. It seems like the Fed is trying to walk back a bit from the Wednesday script.

Key Takeaway : The Fed Meeting was a “shock and awe” event that sent markets to the moon. With average rates now back into the high 6% range, the housing market should prepare for a cautiously-optimistic 2024. Affordability improves when rates pull back and sellers with lower interest rates may be encouraged to sell which could result in more inventory.

The market is extremely fragile, though. If Powell decides to back track on his dovish comments, I believe markets will panic resulting in a whipsaw in the wrong direction.

Let’s Get Together in Early 2024

Kreg and I are hitting the road in the new year. We want to see your faces and help you and your team hit your 2024 goals. Topics could include business planning, market updates, social media or any other relevant topic that could benefit you and your team.

Book a quick 30 minute call with us so we can get a date scheduled before the spring selling season really takes off 🚀