Market Update - December 26th, 2023

With the holidays upon us, Nick and I wish to take a moment to send our heartfelt greetings to you and your loved ones. May this holiday season be filled with joy, laughter, and precious moments spent with family and friends.

Rest assured, even during this holiday season, we remain committed to keeping you informed with the latest and greatest! In the ever-active mortgage world, our dedication doesn't take a break!

We are posting regular content to Instagram (Nick | Kreg) and Facebook (Nick | Kreg) to help you and your buyers. Be sure to follow us!

Read time: ~4 minutes

Could Rate Cuts Start as Early as March ✂

Since late October, we observed rates reaching their highest point at 8%. Following that period, we've experienced a continuous decline in interest rates for eight consecutive weeks.

The main reason for this rapid change in mortgage rates is that many believe the Fed has stopped raising rates. Right now, the Fed Funds Futures market, which predicts future interest rate moves, suggests that not only will there be no more rate hikes, but there's also a decent chance that the Fed may cut rates as soon as March 2024.

The next two Fed meetings take place on January 31st and March 20th. If we were betting men, we would bet that the Fed will not cut rates in January. We are targeting March as well for the first time the Fed decides to officially “pivot” and cut rates.

Why March? Our guess is that the Fed is close to cutting rates based on their recent commentary. However, not close enough to lower rates as early as January. March is intriguing because it coincides with the expiration of the Bank Term Funding Program (BTFP), which is a government funded program that has kept the banking system on life support.

Key Takeaway : Markets anticipate future events, and the shift in lower mortgage rates indicates that the market believes the Federal Reserve has plans for a pivot and cut rates in the near future.

What Spooked the Fed? - Bank Term Funding Program 👻

Many market experts are puzzled by the sudden shift in Fed Chair Jerome Powell's stance, as he is now suggesting multiple rate cuts in 2024.

So why is Powell suddenly waiving the white flag? Nick and I believe it has to do with the Bank Term Funding Program (BTFP) that is set to expire in March 2024.

You may recall in the beginning of 2023, we saw a rapid rise in bank failures that signaled the onset of a potential banking crisis. To calm the markets, the Fed introduced the BTFP program - an emergency lending program aimed at averting a widespread economic collapse. The BTFP program essentially injects money into struggling banks to keep them afloat.

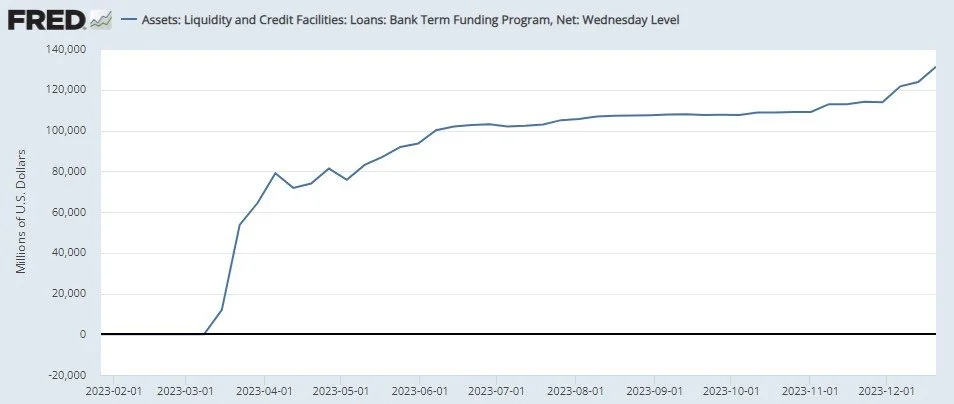

What’s extremely concerning is the number of banks tapping into these emergency loans continues to rise at an alarming rate as banks continue to struggle (chart 1). Even though the BTFP program was supposed to wrap up in March 2024, the Fed continues to give out more and more loans under this program.

Chart 1 : Usage of the Fed’s BTFP Bank Bailout Fund Jumps to $131 Billion

This troubling pattern aligns with Powell's sudden shift in sentiment from “higher for longer in 2024” to “rate cuts in 2024”. No wonder the Fed is in a rush to prepare the market for rate cuts as it is clear that banks are continuing to struggle financially.

Key Takeaway : The BTFP is set to expire in March 2024. Without BTFP, we would see the regional bank crisis return instantly. The Fed is aware and explains why Jerome Powell is suddenly signaling the need to cut rates in 2024.