Mortgage Update - June 3rd, 2024

Good morning team! It was a short news week, but the news was sneakily volatile for interest rates. We dive into the good, the bad and the ugly in this week’s newsletter. Kreg and I also share something valuable to talk about at all those graduation events you are attending.

Let's dive in!

We are posting regular content to Instagram (Nick | Kreg) and Facebook (Nick | Kreg) to help you and your buyers stay informed. Be sure to follow us!

Read time: ~3 minutes

US Economy Shows Weakness

It’s taken much longer than expected, but data is starting to show that the US economy is weakening.

Over the last week, we’ve seen some worrying headlines:

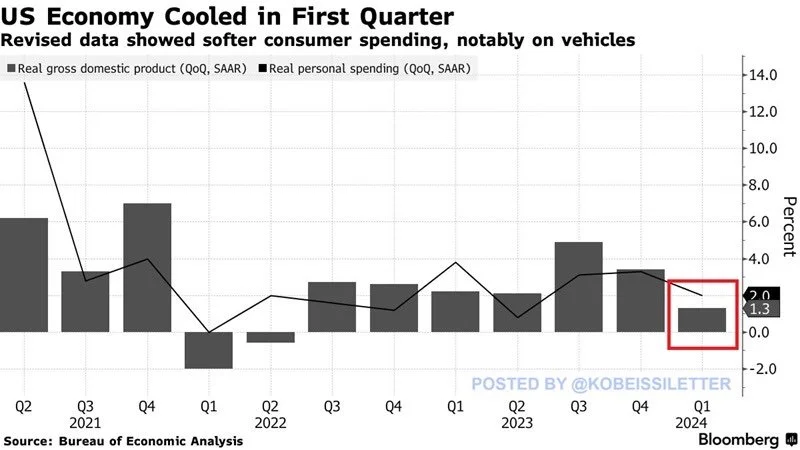

US Q1 2024 GDP is revised down to 1.3% vs. the 1.6% initially reported last month. The biggest driver was slower consumer spending especially on vehicles. Back in Q4 2023, GDP was 3.4%. Growth domestically is slowing rapidly.

A “Restaurant Apocalypse” is beginning across America. It might not be felt in towns like Columbus, OH where every restaurant is jammed. But domestically, more and more people are choosing to cook rather than eat out. Visits to sit-down restaurants dropped 5% in 2023. In New York alone, 40 bars and restaurants closed from Dec 2023 to Jan 2024. Boston Market filed for bankruptcy. Consumers simply have less discretionary income, the cost of goods for restaurants to operate is up 30% AND higher staff wages are killing their bottom line.

On Friday, the University of Michigan’s survey consumer sentiment dropped 13% in May. That’s the biggest one-month drop since mid-2021. The average American is concerned about the second half of the year. Heightened anxiety around rising unemployment, rising inflation and a volatile election are weighting them down.

Key Takeaway: So what’s the big deal? A weak economy will need stimulus to bring growth back into the market. One big lever to pull is for the Fed to make money less expensive to borrow. As rates pull back, individuals and businesses are more likely to take advantage of the cheap money and invest in new ideas. Additionally, mortgage rates would pull back luring buyers back into the market who have been on the sidelines due to high borrowing costs.

New Homes ARE the Market 🏠

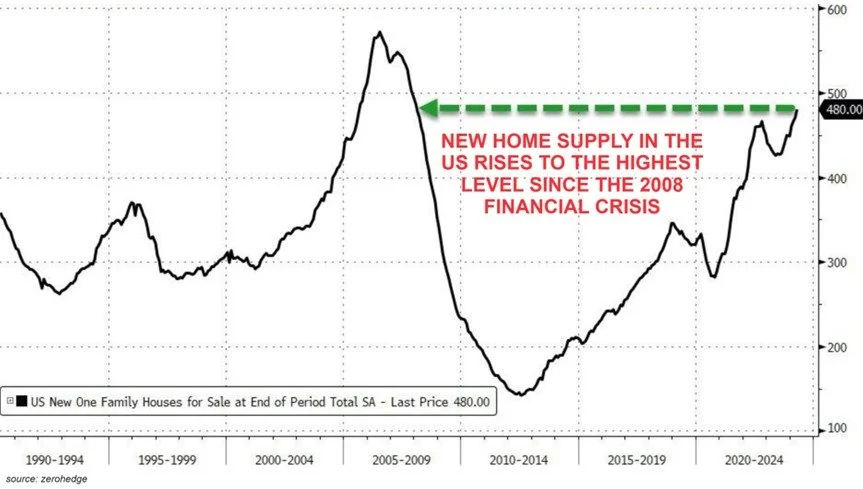

From the Kobeissi Letter on X, the number of NEW single-family homes for sale exploded to 480,000 in April, which is the highest reading since the 2008 financial crisis.

This marks the second largest supply of new homes in US history.

Additionally, the median price of a new home is at $433,500 which remains near record highs.

Kreg and I have seen many, many buyers moving to new builds vs. buying existing.

Key Takeaway: It will be interesting to see what happens as new build inventory remains at historic highs and more existing inventory comes on the market. Hopefully with an increase in inventory levels, we start to see some relief on home prices across the board.

Graduates Can Get a Special Grant 🎓

Graduation season is upon us! Remind your friends, relatives and past clients that if they have any ambitious graduates in their lives that want to own a home to check out OHFA’s Grants for Grads program.

First-time borrowers must have graduated within the last 48 months with an associate’s, bachelor’s, master’s, doctorate or other post-graduate degree from an accredited college or university.

The grad program offers discounted mortgage rates AND assistance of 2.5% or 5.0% of the purchase price. Relative to other OHFA assistance loans, the grants for grads program is forgivable after 5 years rather than 7 years.

One other unique benefit is the ability to refinance your first mortgage and subordinate the forgivable assistance. That means if rates pull back, graduates can refinance outside of OHFA.

Jobs Week Ahead 👷♂️👷♀️

It's the first week of the month, which means all eyes are on the jobs reports:

Tuesday - JOLTs Job Openings data

Wednesday - ADP Non-Farm Employment data

Friday - BLS May Jobs Report (the big one)