Mortgage Update - May 27th, 2024

Hello all! Hope you are having a wonderful Memorial Day! Be sure to take a moment to remember and express gratitude to those brave men and women who made the ultimate sacrifice for our freedom. We are back for another weekly mortgage update!

Let's jump in!

We are posting regular content to Instagram (Nick | Kreg) and Facebook (Nick | Kreg) to help you and your buyers stay informed. Be sure to follow us!

Read time: ~3 minutes

Are Stocks at All-Time Highs Bad?

I usually avoid checking my 401k balance regularly as I live by the "set-it and forget-it" philosophy of investing. However, I felt compelled to take a peek when I heard the markets reached all-time highs earlier in the week. To my surprise, my 401k had increased by 19% over the last 12 months, which is completely insane!

After a brief moment of excitement, my thoughts quickly shifted to, "How is this going to affect mortgage rates?"

While the white-hot stock market is wonderful for our investment portfolios, it makes those of us in the mortgage industry a bit uneasy. We need to remember that the Federal Reserve rapidly increased rates over the past couple of years to cool the economy. In 2022, inflation soared to 9%, far above the Fed's target of 2%. In order to fight inflation, the Fed raised interest rates to increase costs for consumers. The idea is that with higher costs, people would spend less, leading businesses to lower prices, and ultimately reducing prices/inflation.

For the most part, the Fed higher rate policy worked, bringing inflation down from 9% to our current level of 3.4%. However, we've been stuck in this mid-3% range for almost a year now. Jerome Powell has repeatedly stated that inflation must drop to their target level of 2% before they will consider lowering rates.

But how can we expect inflation to fall if the stock market continues to soar? Higher investment portfolios boost consumer confidence and spending. More spending leads to higher inflation, which is exactly what we need to avoid 🙁

Key Takeaway: A strong economy could cause inflation to remain sticky. If inflation doesn't decrease to the 2% target level, the Fed may have no option but to maintain higher rates for an extended period. If the stock market stays strong and jobs are abundant, the likelihood of a rate cut in 2024 continues to diminish. Expect rates to remain higher for longer.

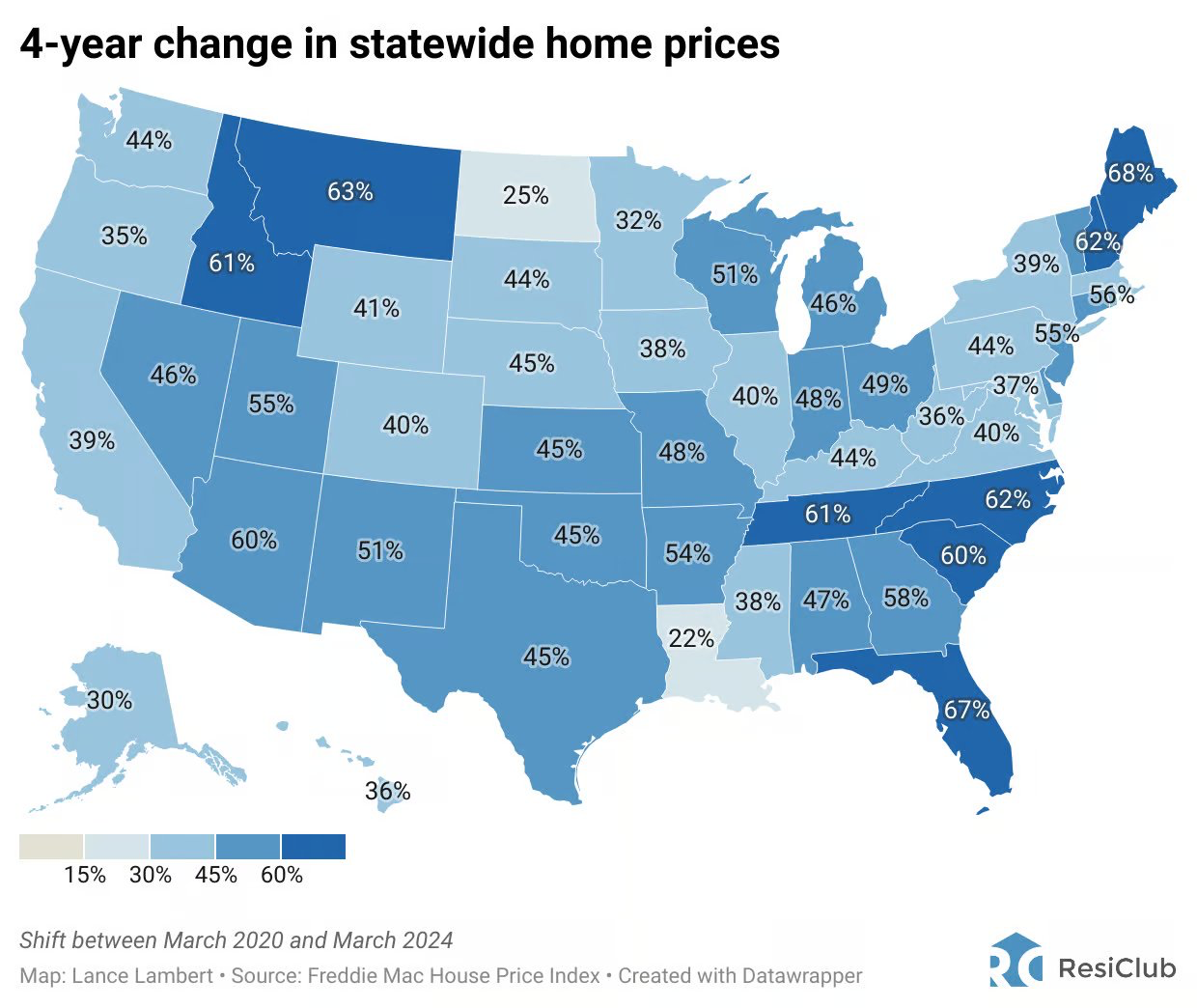

4-year Change in Home Prices Soar 📈

Last week, I came across a striking chart showing the average 4-year change in statewide home prices. From March 2020 to March 2024, Ohio saw an incredible 49% increase in average homes prices! As someone who closely follows the industry, this figure actually did not surprise me. Ohio boasts plentiful jobs, affordable housing, and an influx of corporations. Honestly, I'm surprised the increase wasn't higher.

It's incredible to consider the number of corporations that have committed to establishing roots in Ohio that are still in the development/construction phase. For instance, Intel's project isn't expected to be completed for another year or two, but it's anticipated to create over 3,000 permanent jobs. Imagine the impact on home prices when 3,000+ people relocate to work at Intel alone. The 49% price increase we've seen might seem like a drop in the bucket.

Nick and I stress this point when speaking with potential homebuyers. We understand that buyers are currently anxious and hesitant, given the ongoing coverage by media outlets on high interest rates and the possibility of a housing bubble. It's crucial to remind our buyers that real estate is all about location, location, location. Ohio is a unique place where these substantial investments will permanently reshape our state. Our advice to hesitant buyers is to take action now, before these projects are finalized and an influx of people relocate to our wonderful state.

Key Takeaway: Continue to emphasize the development and growth we are experiencing in Ohio. The demand and scarcity of real estate will only intensify with the influx of jobs entering our market. The affordable home priced under $300k may be a thing of the past in the next 5+ years.

Short But Busy Week Ahead 🤏

It's a short action-packed week with the following events:

Gross Domestic Product (GDP) data for the first quarter of 2024 will be released on Thursday. This report is the broadest measure of economic activity and the key indicator of the economy's health. If the GDP number is strong, expect rates to worsen, signaling a robust economy. If we see a weak GDP number, expect rates to improve, indicating a weakening economy and a potential need for future rate cuts.

April PCE Inflation data will be released on Friday. We should always be on high alert when an inflation report is released. If inflation rises, the market will react negatively, and rates will spike. Conversely, if inflation decreases, expect the markets to rejoice and rates to improve.

A total of 10 Fed speakers will be speaking throughout the week. It will be interesting to hear their commentary, especially as doubts grow about the possibility of rate cuts in 2024.